Description

What is a Waiver of Accounting Form?

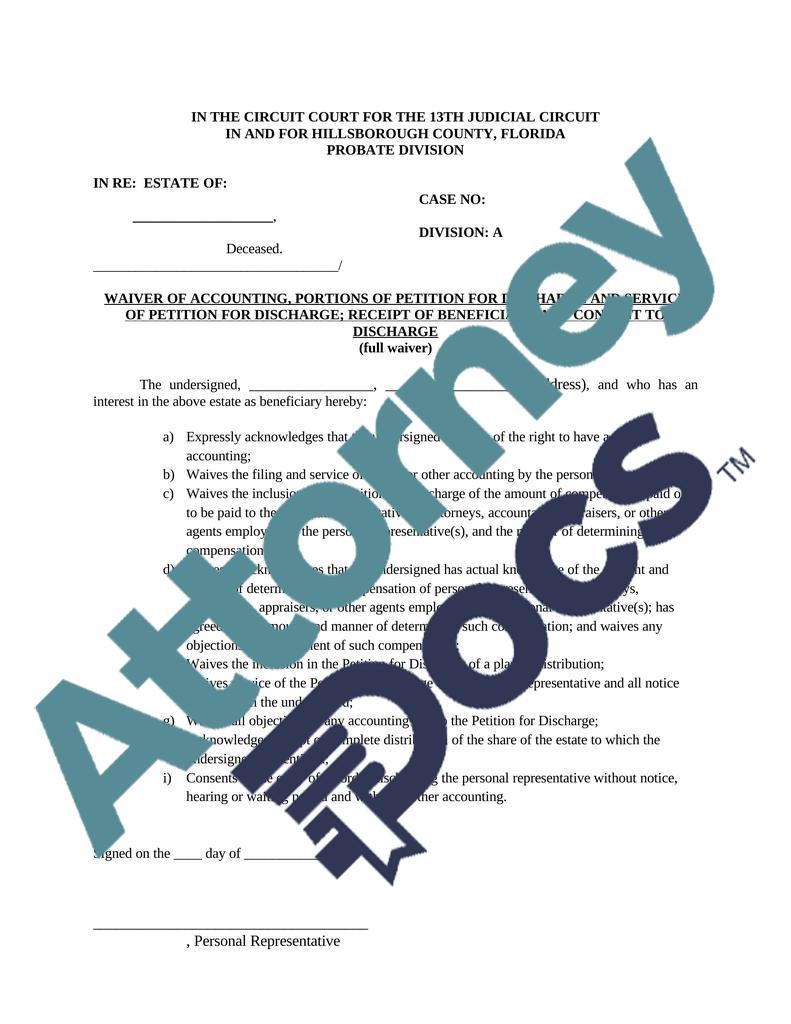

A waiver of accounting form is a simple voluntary form of a Waiver of Accounting and Release.

When the beneficiaries have no reason to request or demand a formal accounting, they may choose to use it in the administration of an estate where the executor (executrix, personal representative, etc.) has done an adequate job and they are comfortable with the job.

The use of this form eliminates a very long and expensive accounting process. The document allows the parties to bring an end to the fiduciary’s duties related to the estate administration. This form is commonly used when a family gets along.

What is an Accounting Waiver?

An account of all funds received and all funds paid out during the administration of the estate must be provided to the court when a petition for final distribution is filed. This process can be waived when all parties involved have completed the accounting waiver.

This waiver simplifies the process and closing of an estate. Many families use this waiver when they have agreed to everything already laid out in the distribution of the estate.

What is a Waiver of Process?

Waiver of process forms indicate that you have no disagreements with a will. That all of the information is correct and you will not fight the naming of the executor.

This takes out the process, there are a few reasons you would not want to sign a waiver of process. If the will was not properly executed, if someone influenced the testator when making the will, or if the testator was not mentally capable of making decisions while writing and submitting the will.

You should also not sign the waiver of process if you do not agree with the named executor. Once you do decide to sign the waiver of process there is nothing else for you to do.

It is important to understand that when you sign this waiver you are not giving up your inheritance you are simply allowing the named administrator the okay to probate the will.

Do Beneficiaries Have to Approve Estate Accounts?

Estate executors have certain responsibilities to the beneficiaries of their estates. Whenever an executor does not fulfill their obligations, beneficiaries have certain rights to force him or her to do so. Usually, they do this through the courts. Any compensation requested by the executor must also be reviewed by the beneficiaries. If they do go to court then the executor will have to go over everything in and out of the estate.

Should I Waive Trust Accounting?

There are trust documents that waive the trustee’s duty to account to the beneficiaries. The law allows this, but a court may ultimately order an accounting when necessary to protect beneficiaries.

Usually the trust’s creator waives the obligation to provide accountings because they want to reduce costs associated with trust administration. When deciding if you should waive the accounting, look at all options before you make a final decision, and what is best for you and other parties who may be involved in the trust.

What is an Accounting Probate?

An estate’s probate accounting is the detailed accounting of all transactions that took place within a reporting period. The appointment, termination, or change of a trustee usually requires trust accounting.

Also, it is required when a current trustee petitions for the estate’s final distribution or closure. In the probate accounting process, the forms needed for the accounting period vary from state to state.

There are three essential aspects of probate accounting that govern how an estate or trust is administered and led. Understanding the estate’s assets, income, disbursements, and final accounting.